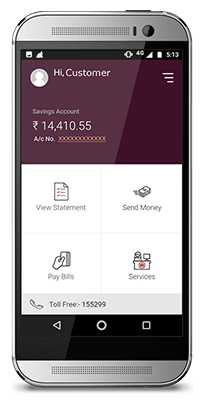

IPPB Merchant Banking Mobile App

IPPB’s cashless payment solution for your business needs.

Introducing the all new IPPB Merchant App!

Now accept payments in style and grow your business without the hassles of physical cash, loose change or soiled notes. It’s safe, secure and convenient to use. And its free like it always will be!

Key Features

- Hassle free registration with just a mobile number registered with IPPB

- Accept payments for goods/services sold: This solution is available using:

- Transactions initiated by customer i.e. scanning a QR code and making payments in a push transaction mode.

- Transactions initiated by merchant i.e. accepting payments from the IPPB customer via Account Number + OTP, scanning customer QR card + OTP, Aadhaar Number + OTP.

- Accept unlimited payment transactions unlike wallets

- Receive instant SMS notifications for your transactions

- Complete overview of sales and business performance on the dashboard

- Direct settlement into IPPB account

- Initiate instant refunds to the customer in case of any disputes/duplicate payments